Warning!

The Xero API Integration has been superseded by the Xero OAUTH2 Integration.

Please refer to the Xero OAUTH2 topic for information on setting up Xero with Idealpos.

This page has not been removed for historical and reference purposes.

The steps included on this page may no longer be valid, and therefore, we encourage you to refer to the Xero OAUTH2 topic.

Australia and New Zealand have different rules for Layby sales.

In New Zealand, regardless if your business is Cash or Accruals Accounting, the Layby becomes a sale on the Final Payment Made. All layby details are stored in Idealpos.

With the GST Accounting Method set to Accrual, Laybys become a Sale when the Final Payment is made.

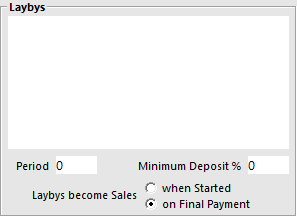

Go to Setup > Global Options > Customers > Layby becomes Sales on Final Payment.

In Setup > Global Options > Miscellaneous, set the GST Accounting Method to Accrual.

A Lay-by sale of $50 inclusive of GST with a $10 Deposit paid on Cash.

A Final Payment of $40 has been applied to the layby.

A Lay-By sale of $50 Inclusive of GST with a deposit of $10.00 Cash. An Adjustment of $1.00 was applied to this Lay-By with an owing balance of $39.00.

Debit Adjustments cannot be performed when using the Accounting Module Interface.

Cancel a $50.00 Lay-By with a deposit of $10.00 Inclusive of GST.

The customer’s initial $10 deposit will be fully refunded with no cancellation fees.

The first Journal shows the initial sale of $50 and $10 deposit:

Then the Layby Cancellation refunding monies paid:

Cancel a $50.00 Lay-By with a deposit of $10.00 and a service fee of $5.00 and refund of $5.00.

The first Journal shows the initial sale of $50 and $10 deposit:

Then the Layby Cancellation refunding monies paid less the $5.00 layby cancellation fee:

With the GST Accounting Method set to Cash, Laybys become a Sale when the Layby is first Started.

Go to Setup > Global Options > Customers > Layby becomes Sales when Started.

In Setup > Global Options > Miscellaneous, set the GST Accounting Method to Cash.

A Lay-by sale of $50 inclusive of GST with a $10 Deposit paid on Cash.

A Final Payment of $40 has been applied to the layby.

A Lay-By sale of $50 Inclusive of GST with a deposit of $10.00 Cash. An Adjustment of $1.00 was applied to this Lay-By with an owing balance of $39.00.

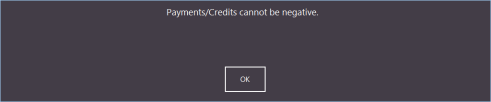

Lay-By Payments and Credits cannot be negative.

Cancel a $50.00 Lay-By with a deposit of $10.00 Inclusive of GST.

The customer’s initial $10 deposit will be fully refunded with no cancellation fees.

The first Journal shows the initial sale of $50 and $10 deposit:

Then the Layby Cancellation refunding monies paid:

Cancel a $50.00 Lay-By with a deposit of $10.00 and a service fee of $5.00 and refund of $5.00.

The first Journal shows the initial sale of $50 and $10 deposit:

Then the Layby Cancellation refunding monies paid less the $5.00 layby cancellation fee: